An endowment provides income in perpetuity for scholarships, faculty, and University programs for generations to come. When you create and fund an endowment, the principal (or corpus), is invested permanently in a diverse portfolio and a portion of the annual earnings are distributed to support only the purpose designated by the donor for which the endowment was created. The goal is to ensure that the fund maintains its purchasing power over time to support future generations.

As other sources of revenues such as state appropriations, grants, and research sponsorships can be unpredictable, an endowment provides a consistent, reliable, and perpetual source of income for programs and services that inspire and fund the academic endeavors on campus. The larger the endowment is, the greater the income that can be provided; and therefore, the more opportunities available for students, faculty, and University programs.

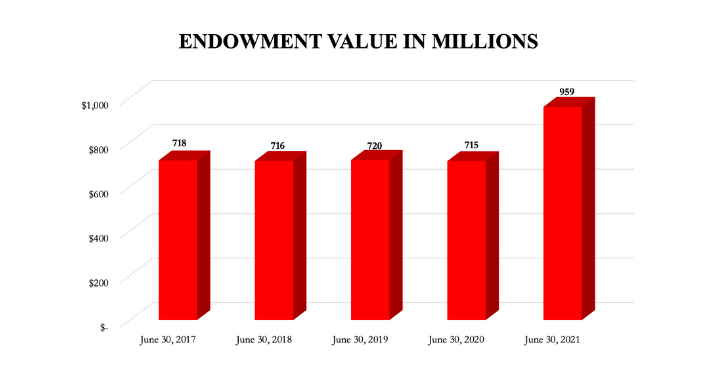

The Value of the Foundation’s Endowment on June 30th of 2017 was $718 million. On June 30th of 2018 it was $716 million. On June 30th of 2019 it was $720 million. On June 30th of 2020 it was $715 million. And on June 30th of 2021 it was $959 million.

The Investment Subcommittee of the University of Louisville Foundation provides direction and oversight for the investment of the Foundation’s financial assets. The primary purpose of the Investment Subcommittee is to manage the investments of the endowment pool and those managed by other investment partners. The Subcommittee fulfills its fiduciary duties by adhering to the Kentucky Uniform Prudent Management of Institutional Funds Act (“KUPMIFA”). The Foundation employs a Chief Investment Officer, Prime Buchholz, which develops its investment approach in concert with the committee and directs the implementation of investment strategy pursuant to a formal investment policy statement.

Each endowment account managed by the Foundation essentially operates like a part of a mutual fund. The assets of the individual funds or accounts are pooled and invested as a single portfolio. In addition to reducing administrative expense, this pooled approach provides additional investment opportunities for these funds due to economies of scale associated with many of the asset classes. ULF invests the pooled endowment to maximize long-term returns, while simultaneously mitigating risk through maintaining a diversified portfolio. The spending from each account is only to support those areas identified by a donor’s gift agreement.

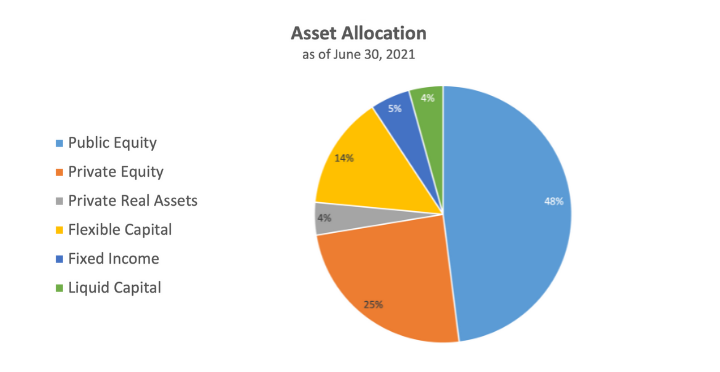

Asset allocation involves dividing assets on a percentage basis among different broad categories of investments. The selection of investment classes has been shown to be one of the most important determinants of a portfolio’s return. The University of Louisville Foundation’s Board of Directors approves the Investment Policy of the Foundation, which includes asset allocation guidelines.

The fund’s asset allocations can be summarized as follows*:

The fund’s asset allocations can be summarized as follows*:

*as of June 2021

Under the guidance of its Investment Subcommittee and with its chief investment partner Prime Buchholz, the University of Louisville Foundation has put a strategic focus on keeping costs low and maintaining a simplified portfolio with a strong holding of U.S. public equities.

The fund’s asset allocations can be summarized as follows*:

*as of June 2021

The Foundation maximized investment gains in its endowment pool during the robust financial market over the past fiscal year, growing our pool 39.2%.

As of June 30, 2021, the combined amount of ULF accounts and the University of Louisville Real Estate Foundation assets was over $1.3 billion. Both the endowment pool and the Foundation’s total assets were valued at their highest levels in history.

Endowment Spending Policy Distribution and Impact

Upon the recommendation of the Finance Committee, the Foundation Board of Directors approves an endowment spending policy that creates a distribution for each individual endowment account. The spending policy distribution is based on a total return approach in order to maintain stable cash flows over an extended period of time, to protect endowment funds against inflation, and to preserve and grow the purchasing power of the endowment. The Foundation’s spending policy is calculated by applying a distribution rate to a rolling average based on the prior twelve quarters’ market value as of December 31 of the prior year. This distribution is then made available to the University of Louisville the following July 1.

Once an endowment generates a payout, the funds are made available to the University on a reimbursement basis to the designated area as established by the donor’s gift agreement. The Foundation then undertakes a rigorous compliance review to ensure funds were spent consistent with the designated purpose.

Growing our endowment is not about having a bigger number. It is about the impact the endowment payout, or spendable distribution, can have on the lives of students, the efficacy of the education that can be provided, the world-changing research that can be accomplished, and the economic impact our real estate holdings can on our city, our commonwealth, our region, and the world.

Endowment Giving

Your gift to support UofL will help fund scholarships and fellowships, endowed chairs and professorships, and initiatives that make the University of Louisville’s education exceptional, build a knowledge-based economy, and drive innovation.

There are many ways you can support UofL. Make your gift give or complete this contact form or contact us at 502-852-6588.

To view your University of Louisville giving history (for this tax year or any other), register or log in to our donor portal. Your information is password protected on our secure website:

If you would prefer to communicate about your giving history over the phone, call 502-852-6588.

Endowment and Gift Fees

Effective July 1, 2022 the Board has approved a spending policy distribution rate of 4% to the academic units. In addition the administrative fee has been reduced to .75%.

The support from donors is critical to the continued excellence of the University of Louisville, its students, faculty, and staff. Visit give.louisville.edu to make a gift that will support education, research and, creative discoveries that have become the hallmark of UofL.

The University of Louisville Foundation is governed by a 20-member Board of Directors.

The University of Louisville Foundation is a registered 501(c)(3) charitable organization.